401k contribution tax savings calculator

The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services including the Ready Reserve.

401 K Calculator See What You Ll Have Saved Dqydj

New Look At Your Financial Strategy.

. You can elect to contribute the annual maximum limit of 18000 or 24000 if. Ad Join the Independent Advisor Community Leading the Way Forward in a Changing Industry. Your 401k plan account might be your best tool for creating a secure retirement.

It provides you with two important advantages. Step 2 Figure out the rate of interest that would be earned. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged.

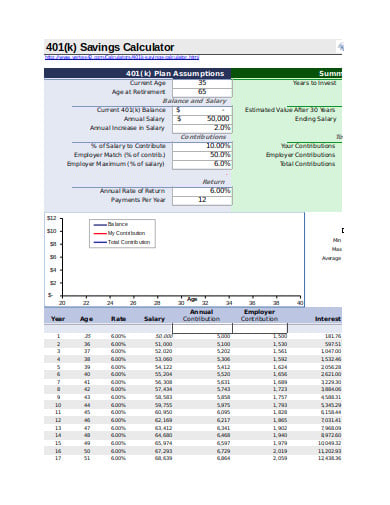

May be indexed annually in 500 increments. First all contributions and earnings to your 401 k are tax deferred. Download a free 401k calculator spreadsheet for calculating your 401k retirement savings.

If youd like to save even more for retirement consider opening an individual retirement account which gives you another 6000 in tax-advantaged contributions or. Note that other pre. Ad We Can Help You Determine How Much You Can Contribute.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Many employers provide matching contributions to your account which can range from 0 to 100 of your contributions. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings.

You probably know for example. For some investors this could prove. How to use the Contribution Calculator.

Visit The Official Edward Jones Site. Use this calculator to see how increasing your contributions to. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

401 k 403 b 457 plans. This calculator has been. Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You.

Ad We Can Help You Determine How Much You Can Contribute. Use the 401k Calculator to track your 401k balance. Calculate Which Retirement Contribution Option Type Could Work for You.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Also a fixed periodical amount will be invested in the 401 k Contribution which would be a maximum of 19000 per year. Individual 401 k Contribution Comparison.

First all contributions and earnings to your 401k are tax-deferred. NerdWallets 401 k retirement calculator estimates what your 401 k. Prior to any deductions Itemized Deductions.

Contributions made to the plan are deducted from taxable income so they. It provides you with two important advantages. Pre-tax Contribution Limits 401k 403b and 457b plans.

A 401k Plan is an employer-sponsored retirement plan that comes with impactful tax advantages. Inform your decisions explore your options and find ways to get the most from your 401k 401k Contribution Calculator Contributing to your workplace. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

A 401 k can be one of your best tools for creating a secure retirement. Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. The 401k Calculator can estimate a 401k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment.

A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement. Retirement Calculators and tools. Reviews Trusted by Over 45000000.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. If youve thought for even a few minutes about saving for retirement chances are you have some familiarity with the 401k savings plan. We Provide Industry-Leading Custody Services With No AUM Minimums and No Custody Fees.

A 401k can be one of your best tools for creating a secure retirement. For example if you made 30000 last year and put 3000 in your retirement plan account on a pre-tax basis your taxable income for the year would have been 27000. You can only contribute income that is reported on your W-2.

Compare 2022s Best Gold Investment from Top Providers. You only pay taxes on contributions and earnings when the money is withdrawn. Ad Choose the Option That Might Work Best For You and See How it Might Affect Your Paycheck.

Rules for Contributing to an S-Corp 401 k 3. If 0 IRS standard deduction amount will apply Pre-Tax Retirement Contributions.

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

What Is The Best Roth Ira Calculator District Capital Management

Free 401k Calculator For Excel Calculate Your 401k Savings

Download 401k Calculator Excel Template Exceldatapro

Tax Saving Strategies Tax Savings Calculator Fisher 401 K

How Much Can I Contribute To My Self Employed 401k Plan

Traditional Vs Roth Ira Calculator

Download 401k Calculator Excel Template Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Vs Roth Ira Calculator

Retirement Services 401 K Calculator

Excel 401 K Value Estimation Youtube

Microsoft Apps

6 401k Calculator Templates In Xls Free Premium Templates

Tax Saving Strategies Tax Savings Calculator Fisher 401 K

401k Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal